Saudi Arabia and Iran have the ability to establish a significant economic partnership as two of the largest economies in the Middle East.

The potential for economic cooperation has, however, largely gone untapped due to decades of political unrest and regional rivalry that have strained ties between the two nations.

Despite these obstacles, there are indications that Saudi Arabia and Iran’s economic interests could ultimately bring the two countries together, with adequate mediation.

Domains of possible cooperation

One of the primary areas of potential economic cooperation between Saudi Arabia and Iran is the energy sector.

Both countries are major oil producers and exporters, and both are members of OPEC (the Organization of the Petroleum Exporting Countries); and inadvertently, Saudi’s recent oil policies may have actually benefited Iran.

Riyadh’s decision to cut oil production in 2020, as part of an OPEC+ agreement to stabilize oil prices, drove up oil prices, boosting Iran’s oil revenues.

According to VAO news, Tehran’s oil revenues dropped from USD 100 billion in 2018 to USD 8 billion in 2019, after the US withdrew from the Joint Comprehensive Plan of Action (JCPOA), also known as the Iran nuclear deal.

Since then, Iran has been exporting at the rate of nearly 600,000 barrels per day, at the lowest estimates, through various licit and illicit channels.

Considering the average price of around USD 90 per barrel for 2022, thanks to Saudi’s stand on oil production and prices, Tehran made USD 20-22 billion out of oil revenues in the year 2022 alone.

In fact, higher estimates place Tehran’s oil revenues in 2022 at around USD 45 billion. But that is unlikely, as it would have prevented – or at least mitigated – the ongoing financial turmoil in Iran.

After the first oil production cut in 8 years, in 2016, Riyadh has been quite consistent in its stance regarding oil production, export and prices.

Ever since Crown Prince Mohammad bin Salman announced his Vision 2030 for Saudi Arabia, he’s been adamant on maximizing oil revenues to help finance development in non-oil sectors of the economy.

Despite being under entirely different conditions, bin Salman’s stances have helped both Tehran and Riyadh hedge against the challenges facing each of their country’s economies.

Will Saudi-Iranian interests collide again?

Saudi’s approach on oil production and exportation is calculated.

While work is underway to increase production, careful measures and balances are being set to avoid another decline in oil prices in the near future.

However, the Khurais oil field is slated for growth, which could result in further competition with Iran as a result of recent Saudi Arabian efforts to enhance its oil production capacity.

Nonetheless, given the global oil demand, both countries may find it more profitable to cooperate on energy production rather than engage in zero-sum competition.

Since Russia invaded Ukraine, friction between Saudi and the United States of America (USA) has built up over oil production and prices.

This, coupled with the American relative withdrawal from the region, places Saudi in a difficult position.

Riyadh has to realign itself to find new allies, such as Russia and China, to fill in the US’s metaphorical shoes, and find new ways to reposition itself visa vie its regional rivals and allies.

This means that Saudi can no longer appease the US at its own expense, with little to no American guarantees in return.

In the meantime, the US is pushing sanctions against Russian and Iranian oil and gas to stifle Iran and Russia’s economy, while Saudi will not allow oil prices to drop.

Without Riyadh’s historical alliance with the US, and the ongoing global economic race, Saudi has a lot of catching up to do, and it is doing it.

According to recent statements by Saudi officials, this comes as a result of Riyadh’s new approach to prioritize Saudi interests above all else; a brand new Saudi First tenet, ushering in a new era of Saudi-centric foreign policies that do not entail appeasement.

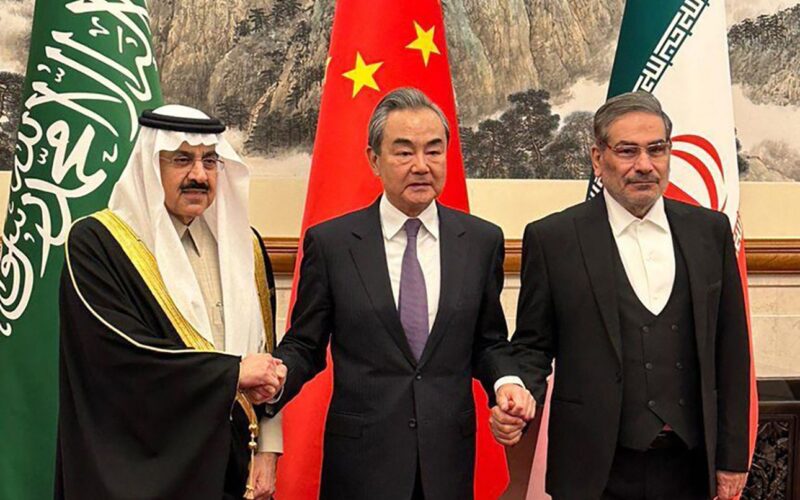

The most recent indicator of such shifts in Saudi foreign policy is the series of talks with Iran, which took place in Iraq and Oman, leading to the recent successful Chinese mediation.

Looking forward, this could soon lead to the full restoration of bilateral ties between the two rivalling oil-producing countries.

Normally, any such rapprochement would be unfathomable in light of the continued conflicts in Yemen and Syria. But we have seen countries overcome the gravest of differences overnight when their interests converge.

Not so long ago, France and Britain were at each other’s throats, to the point that the British Empire actually allied itself to the Ottomans to fight off the French in Egypt and Syria.

The British also went to war alongside the Ottomans against Russia during the Balkan Wars, only to later on turn against the Ottoman Empire and divide the region with France and Italy.

Furthermore, the British regime and the Nazi government of Germany, pre-WWII, were pretty close. They even signed the Jewish Transfer Agreement, to facilitate the relocation of Jewish populations from Germany to Palestine, which was under British Mandate at the time.

Not ten years after that, the British and the Germans were at war.

So, as the tides turn, so do the alliances of nations.

What’s in it for Saudi and Iran?

In this case, Iran and Saudi actually have much to gain from working together, beyond oil.

Trade is one area where collaboration between the two countries may be possible.

Despite the political tensions between the two countries, trade between Saudi Arabia and Iran has subtly continued at a minimum over the span of decades.

Other sectors in which both countries could benefit greatly from cooperation are healthcare, education, tourism and infrastructure development.

More so, as both countries push to enter the BRICS+ economic group, they are bound to find common grounds for cooperation and collaboration, regardless of the conflicts ongoing in Syria and Yemen.

According to an International Monetary Fund (IMF) report from 2021, economic integration and cooperation between the members of the Gulf Cooperation Council (GCC) and neighbouring countries, including Iran, could result in a 1.5% increase in the collective Gross Domestic Product (GDP) of these countries.

In terms of oil and energy, optimal cooperation between Iran and Saudi Arabia alone could lead to increased efficiency and productivity by up to 400,000 barrels per day, a report by the Oxford Institute for Energy Studies published recently estimates.

This is an increase in the oil revenues of both countries by $11.4 billion, in light of the stability of the Brent barrel price at $78.12, as it was on April 10, 2023.

More so, improved security and stability in the region, as a result of military cooperation between the rivalling countries could create a more favourable environment for economic growth and investment.

According to the World Bank, a decline in security risk by 10% could bolster the entire Middle East and North Africa (MENA) region’s income growth per capita by 1%.

Naturally, the extent of Tehran and Riyadh’s cooperation will be capped by their own national interest and aspiration. That is if they do not end up undermining each other.

Notwithstanding, there is reason to be cautiously optimistic about the potential for increased economic and perhaps even political cooperation between these rivalling Gulf countries in the years to come. Both countries recently have begun to follow a pragmatic approach in dealing with their economic and political challenges, which portends a new political chapter in the region’s history, shifting the balance of powers in the entire region for good.